Quick Answer: The luxury real estate market on the Kona-Kohala Coast is experiencing a slowdown, with declining sales and prices and increasing inventory. While the rate of decline is moderating, the market has likely not reached its bottom yet. For sellers, waiting if possible is advisable, but for buyers, current conditions may present opportunities.

Key Takeaways: Navigating the Kona-Kohala Coast Luxury Market

- Market Still Declining: Sales volumes and median prices are down, while inventory levels are up compared to last year.

- Slowing Rate of Decline: The pace of price drops and inventory increases has begun to moderate, indicating a potential stabilization ahead.

- Seller Strategy: If you have the flexibility, waiting to sell your Kona-Kohala Coast home is generally recommended to avoid selling into a declining market.

- Buyer Opportunity: For those looking to purchase a luxury second home or investment property, current conditions present more options and potentially better pricing.

- Expert Guidance is Key: Local market nuances on the Kona-Kohala Coast require tailored advice from experienced professionals like The Hawaii Team.

Over nearly two decades selling luxury homes on the Kona-Kohala Coast, I have worked with hundreds of affluent individuals considering buying or selling a second home or vacation rental. One of the most common questions I hear is: “Should I sell my home now, or wait for prices to rebound?”

The answer is not magic—it is a system. What I call the Polimino Market Insight System is the result of years of testing, refinement, and proven results. Rather than simply describing the system, let me answer the five most common questions luxury homeowners and buyers ask about market timing. These are real questions from real clients and the honest answers that explain what we do differently.

What Do the Latest Luxury Real Estate Numbers Show for the Kona-Kohala Coast?

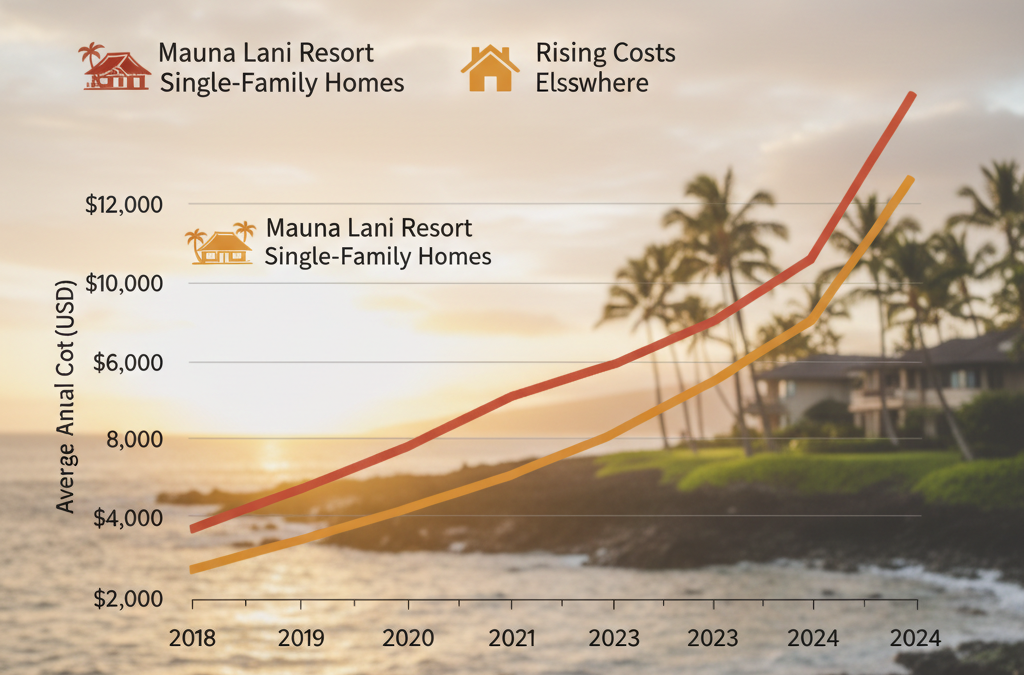

The latest data from the National Association of Realtors (NAR) indicates a continued downturn in the broader market, which often mirrors trends in luxury segments like the Kona-Kohala Coast, although typically with a lag. Existing home sales nationally were down 2.2% from December to January and 23.4% from January 2007. The median price of an existing home in January was $201,100, a 4.6% decrease from January 2007.

While these are national figures, my local analysis for the Kona-Kohala Coast shows similar patterns: increased days on market and a growing inventory. This suggests that sellers need to be more strategic. This type of data-driven analysis is a crucial first step in the Polimino Market Insight System.

Is the Kona-Kohala Coast Luxury Market Still Declining, or Have We Hit Bottom?

Based on current trends, the Kona-Kohala Coast luxury market, like the national market, is still in a declining phase. Sales volumes are down, prices are generally softening, and the inventory of available luxury homes and condos is increasing.

For instance, the average time on the market for a luxury property in areas such as Hualalai or Mauna Kea has extended from 7.9 months to 9.4 months year over year. However, the rate of decline is beginning to moderate. The 4.6% drop in prices from January 2007 to January 2008 is less severe than the 6.6% drop observed the previous year.

This suggests that the market has not reached the bottom yet, but the decline is slowing, which is a key indicator tracked within the Polimino Market Insight System.

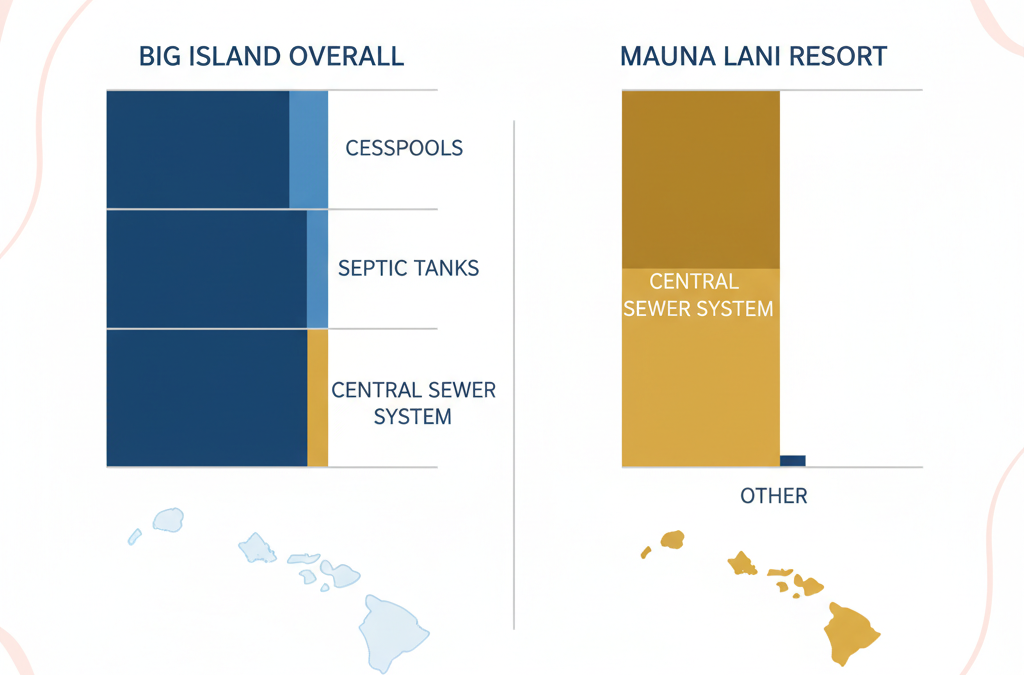

What Does This Mean for Homeowners Considering Selling Their Second Home in Mauna Lani?

If you own a second home or vacation rental in a prime location such as Mauna Lani and are considering selling, this may not be the optimal time if you have flexibility. With prices still declining and a larger pool of homes on the market, you may not achieve the value you desire.

For example, the number of unsold homes nationally increased by 15.6% from January 2007 to January 2008, a trend that is also reflected in local luxury inventory. If you can wait, it may be advisable to do so until market conditions show a clear upward trend. This approach aligns with the strategic timing component of the Polimino Market Insight System.

Is Now the Right Time to Buy a Luxury Condo in Hualalai?

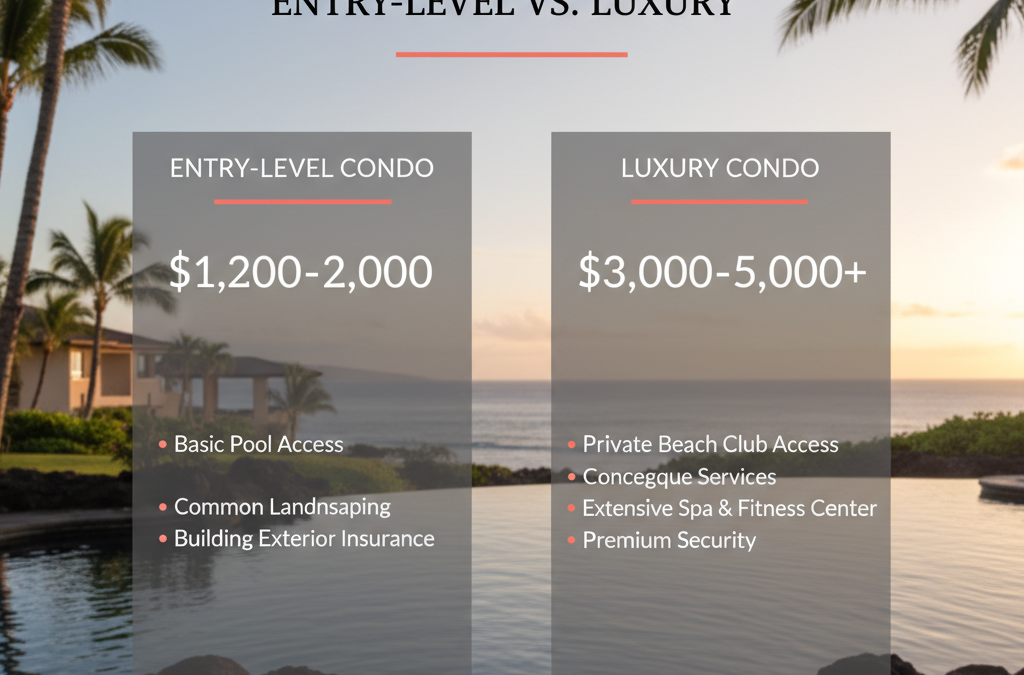

For prospective buyers considering a luxury condo in Hualalai or a similar resort community on the Kona-Kohala Coast, current market conditions may present a strong opportunity. Prices are more favorable, and increased inventory provides a wider selection of properties.

While prices may still adjust somewhat, the slowing rate of decline suggests that significant additional drops may be less likely. Buyers should approach purchases with a long-term perspective rather than expecting a rapid rebound in property values.

Within the Polimino Market Insight System, the strategy is to take advantage of improved pricing and selection while preparing for a gradual market recovery.

How Long Will It Take for the Kona-Kohala Coast Market to Recover?

Predicting the exact timeline for a full market recovery on the Kona-Kohala Coast is difficult. However, historical patterns suggest that recovery will likely be gradual rather than rapid.

The rate of decline is slowing. For example, the increase in inventory from January 2007 to January 2008 was 15.6%, which is lower than the 21.6% increase recorded the previous year. It may take time for buyer confidence to return and for demand to absorb the current supply of homes.

Experience with the Polimino Market Insight System suggests that sustained recovery typically follows a stabilization phase, which the market may just be beginning to enter.

The Bottom Line: Strategic Decisions in a Shifting Market

The luxury real estate market on the Kona-Kohala Coast is currently adjusting. While the market may not have reached its absolute bottom, the slowing rate of decline suggests potential stabilization ahead.

For sellers, patience and strategic timing are important. For buyers, the current environment may present opportunities for long-term investments. Understanding these dynamics is central to the Polimino Market Insight System.

I would not be surprised to see the Kona-Kohala Coast market stabilize further in the coming months before beginning a gradual recovery.

Frequently Asked Questions

Q: What should I do if I have to sell my Kona-Kohala Coast home now?

A: If you must sell, be prepared for a potentially longer marketing period and set realistic pricing expectations. Strategic presentation and strong negotiation become even more important to achieve the best possible result.

Q: How do current interest rates impact the luxury market on the Big Island?

A: Higher interest rates can reduce buyer demand by increasing borrowing costs. However, many luxury buyers purchase with significant cash reserves, making them less sensitive to interest rate changes.

Q: Are there specific areas on the Kona-Kohala Coast performing better than others?

A: Yes. Exclusive communities such as Kukio or Kohanaiki often show greater resilience because of limited inventory and strong demand from high-net-worth buyers.

Q: What is the rental income potential for a luxury vacation rental in Waikoloa Beach Resort in this market?

A: Rental income potential remains solid in resort areas like Waikoloa Beach Resort, though competition and occupancy fluctuations should be considered. A detailed financial analysis is recommended.

Q: How can I get a precise valuation for my Mauna Kea Resort property in today’s market?

A: A precise valuation requires analysis of recent comparable sales, current listings, and specific property characteristics. A detailed Comparative Market Analysis (CMA) can provide an accurate estimate of your property’s value.