On July 30 President Bush signed into law the sweeping Housing Rescue Plan which won final approval in Congress on July 26. This measure aims to help up to 400,000 families avoid foreclosure by allowing them to refinance into more affordable mortgages.

While the primary bill is a good thing and we applaud the government for helping people stay in their homes, not everything about this rescue plan is positive. One item that snuck in under the wire marks the end of seller-funded down payment assistance programs. These programs, which include Nehemiah and AmeriDream, allow home sellers to help buyers with down-payment and closing costs. For example, if a young couple wants to buy their first home but can’t manage the 3 percent down payment, in order to save the sale the sellers may be willing to fork over the cash. However, the only way they can legally do it is by enlisting the help of a non-profit organization such as AmeriDream. Here’s how it works: Let’s say the young couple needs $5,000 for a down payment. The seller agrees to give the $5,000 to the buyers plus a $250 fee payable to the non-profit. The entire amount of $5,250 is paid to the non-profit, and they, in turn, pay the $5,000 down payment to FHA, or whoever originates the loan.

Sounds like a good way for lower- and middle-income Americans to get help with financing. So why did Congress nix it? Perhaps they felt the program has been abused by inflating home prices, thus contributing to the housing market crash. You see some sellers increased the price of their home by $5,000 in order to help pay the down payment for the buyers.

There are some in Congress proposing new legislation to bring these programs back with stricter guidelines, but if that fails seller-funded down payment assistance will end effective October 1, 2008. So if you’re thinking about buying a home and counting on seller down payment assistance, you better be under contract before October 1 as it looks like this opportunity is slipping away.

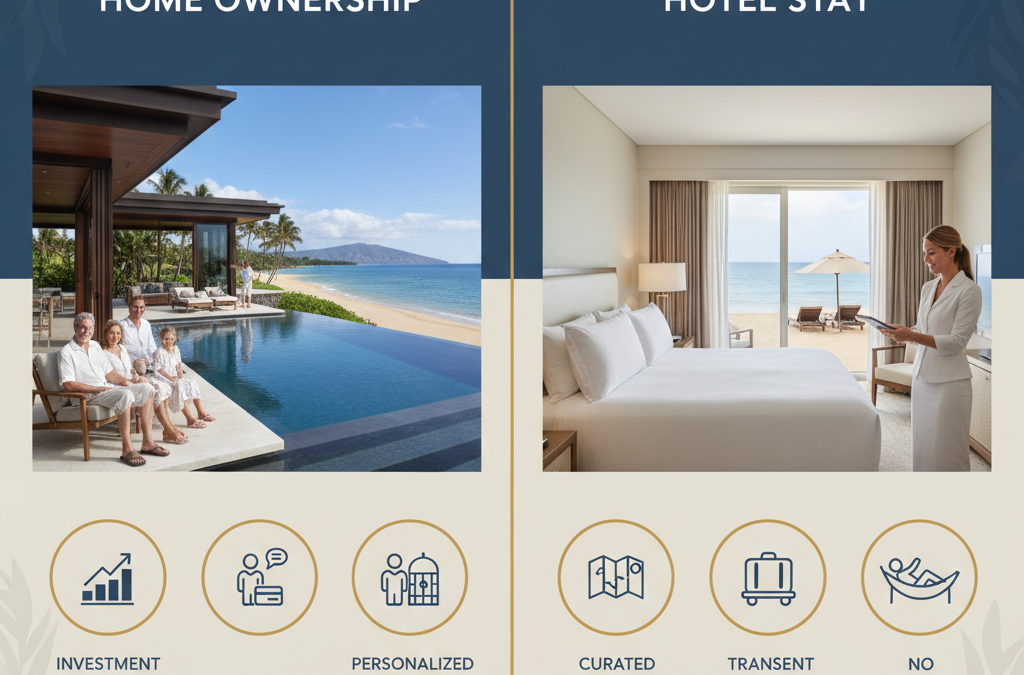

Is Mauna Kea Resort a Good Investment Compared to Newer Big Island Properties?

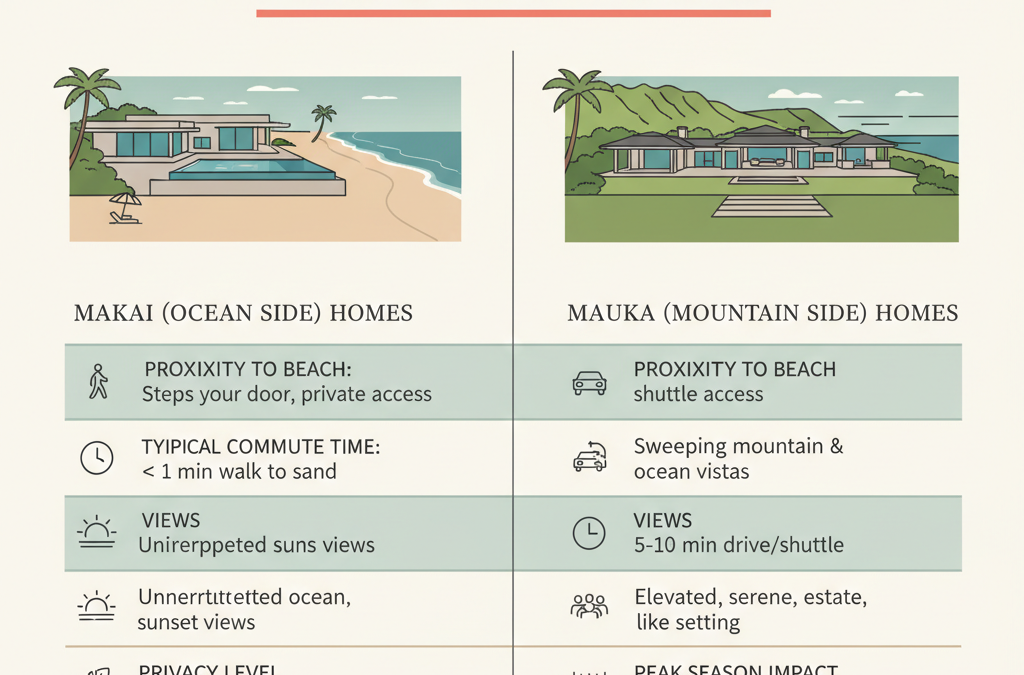

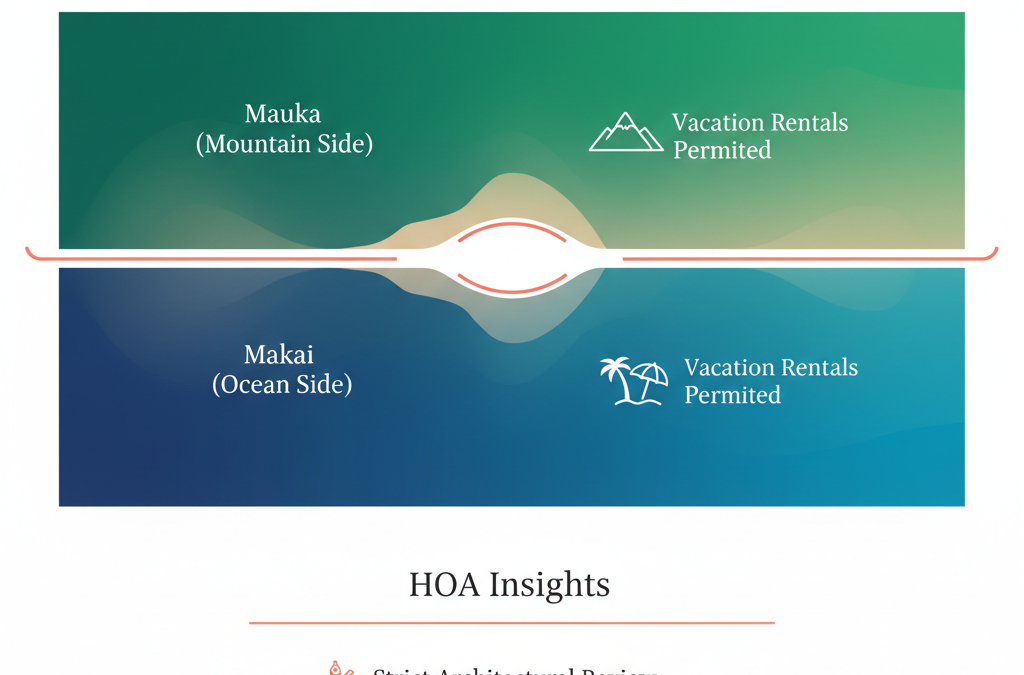

Quick answer: Investing in Mauna Kea Resort—especially the Makai-side villas—can offer strong appreciation and notable buyer loyalty. These properties often compete well against newer developments thanks to their prime setting and distinctive architectural character....